Project Overview

Developed a novel approach for stock price prediction using data-driven discovery of partial differential equations. Created a sophisticated sparse regression framework that automatically identifies minimal mathematical relationships governing stock price movements from high-dimensional time series data.

🔬 Traditional Approach

- Method: Vector Auto Regression (VAR)

- Features: Manual lag selection

- Model: Linear relationships

- Limitations: Fixed structure, limited interactions

💰 Our Data-Driven Approach

- Method: Sparse PDE discovery

- Features: Automatic derivative selection

- Model: Nonlinear differential equations

- Advantages: Discovers hidden relationships

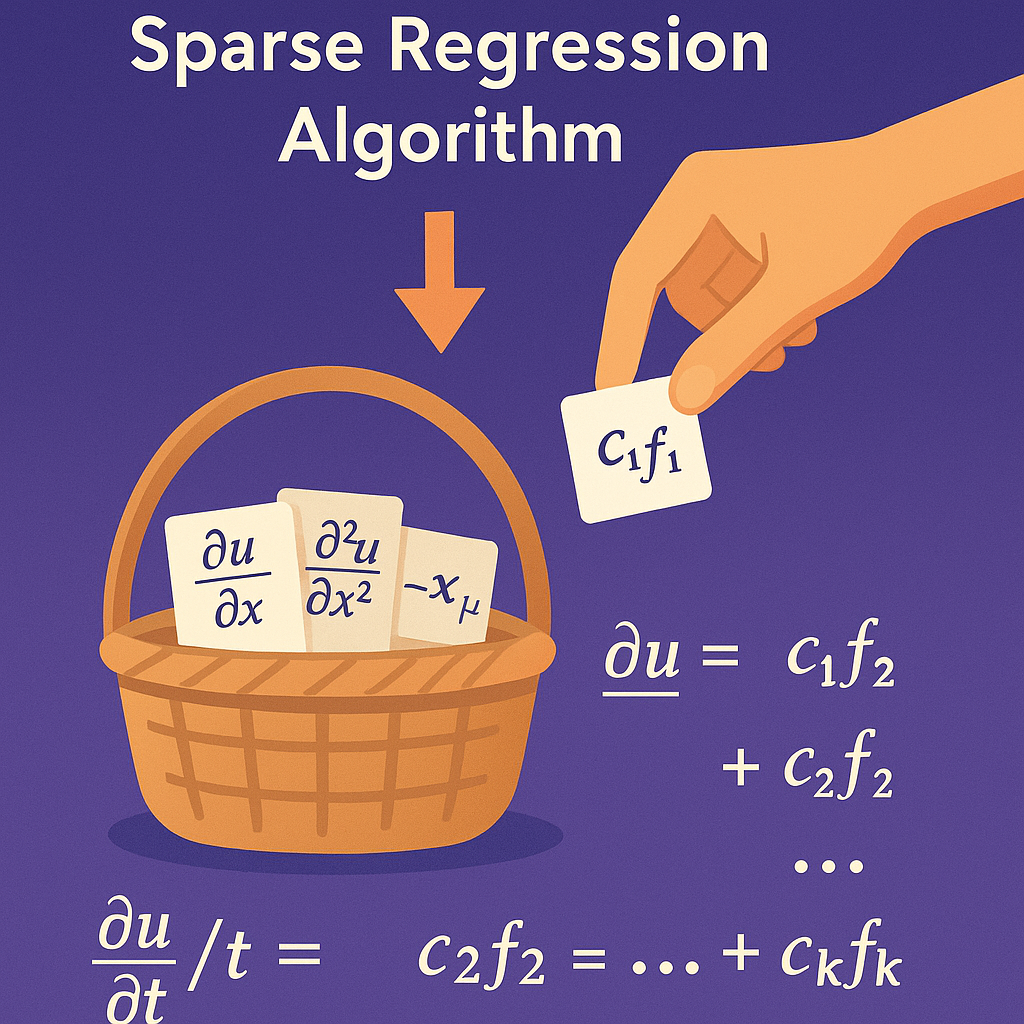

Sparse Regression Framework

🎯 The Sparsity Challenge

Problem: With 5 stocks and derivatives up to 4th order, the feature space explodes to 1000+ potential terms

Solution: Sparse regression automatically discovers the minimal set of relationships that best predict stock movements

∂u/∂t = N(u, ∂u/∂x, ∂²u/∂x², ..., x, μ)

∂(Stock₁)/∂t = c₁f₁ + c₂f₂ + ... + cₖfₖ

where k << total features (e.g., 8 out of 1000+ possible terms)

Sequential Greedy Sparse Selection

Step 1: Feature Explosion

Create massive library of 1000+ candidate terms from stock derivatives

Step 2: Greedy Selection

Algorithm iteratively selects the single term that most reduces prediction error

Step 3: Sparse PDE Discovery

Result: Minimal PDE with only 5-10 truly predictive cross-stock relationships

Step 4: Temporal Validation

Test discovered PDE by making iterative predictions on out-of-sample data windows

Feature Space Size

1000+ potential terms

Combinatorial explosionSelected Features

5-10 key relationships

Sparse, interpretableSparsity Ratio

~99% reduction

Massive dimensionality reductionEconomic Insight

Discovered relationships

Meaningful market dynamicsSparse Algorithm Deep Dive

Why Sparsity is Critical for Financial Prediction

Without Sparsity:

- 1000+ features → overfitting

- Noise masking real relationships

- Uninterpretable "black box"

- Computational burden

With Sparse Regression:

- 5-10 key features → robust

- Signal extraction from noise

- Interpretable market relationships

- Efficient prediction

Sparse PDE Discovery

Successfully identified minimal mathematical relationships (5-10 terms from 1000+ candidates) governing stock price dynamics

Feature Engineering

Developed comprehensive derivative library including temporal and cross-stock relationships up to 4th order

Algorithm Development

Implemented greedy selection algorithm for automatic discovery of predictive mathematical relationships

Data-Driven Framework

Built sophisticated sparse regression system for extracting meaningful patterns from high-dimensional financial data

Feature Library Construction

Temporal Features

dy₁/dt, d²y₁/dt², d³y₁/dt³

Time-based derivatives1st Order Phase

dy₁/dy₂, dy₁/dy₃, dy₂/dy₃

Cross-stock relationships2nd Order Phase

d²y₁/dy₂², d²y₁/dy₂dy₃

Nonlinear interactionsHigher Orders

3rd & 4th order combinations

Complex market dynamicsFeature Generation: All derivatives computed using central differencing for numerical stability. As derivative order increases, feature space grows exponentially, providing rich representation of market dynamics.

Example: From Time Series to PDE

📊 Input: Multi-Stock Time Series Data

Stock Basket: AAPL, GOOGL, MSFT, TSLA, AMZN

Time Period: 5 years of daily closing prices

Feature Generation: 1000+ derivatives (temporal, cross-stock, higher-order)

Selects 8 most predictive terms from 1000+ candidates

+ 0.156 × ∂(AAPL)/∂t

- 0.089 × ∂(MSFT)/∂(TSLA)

+ 0.234 × ∂(GOOGL)/∂(AAPL)

Use PDE to forecast next time step, then chain predictions forward

Interpretable Relationships

PDE reveals that AAPL price tomorrow depends on GOOGL cross-momentum and MSFT-TSLA interactions

Sparse Discovery

Only 4 terms selected from 1000+ possible features - extracting true signal from noise

Predictive Framework

Mathematical model enables forward prediction through iterative integration

Market Dynamics

Discovered relationships capture actual inter-stock dependencies and momentum effects

Key Innovation: Sparse PDE Discovery for Financial Markets

Developed a sophisticated sparse regression framework to automatically discover minimal mathematical relationships governing stock price movements. This approach extracts meaningful market dynamics from high-dimensional time series data, representing a novel application of data-driven differential equation discovery to quantitative finance.