📊 BLS Employment Sentiment Analysis

🎯 Key Finding

The model successfully detected the COVID-19 labor market shock with unprecedented precision, showing a sentiment plunge from 0 to -9 in March-April 2020.

Technical Approach: Multi-Indicator Aggregation

Method: Weighted composite scoring across 6 labor market indicators

Data Sources: BLS API (no authentication required)

Update Frequency: Monthly

📈 Sentiment Components & Weights

📊 Visualizations

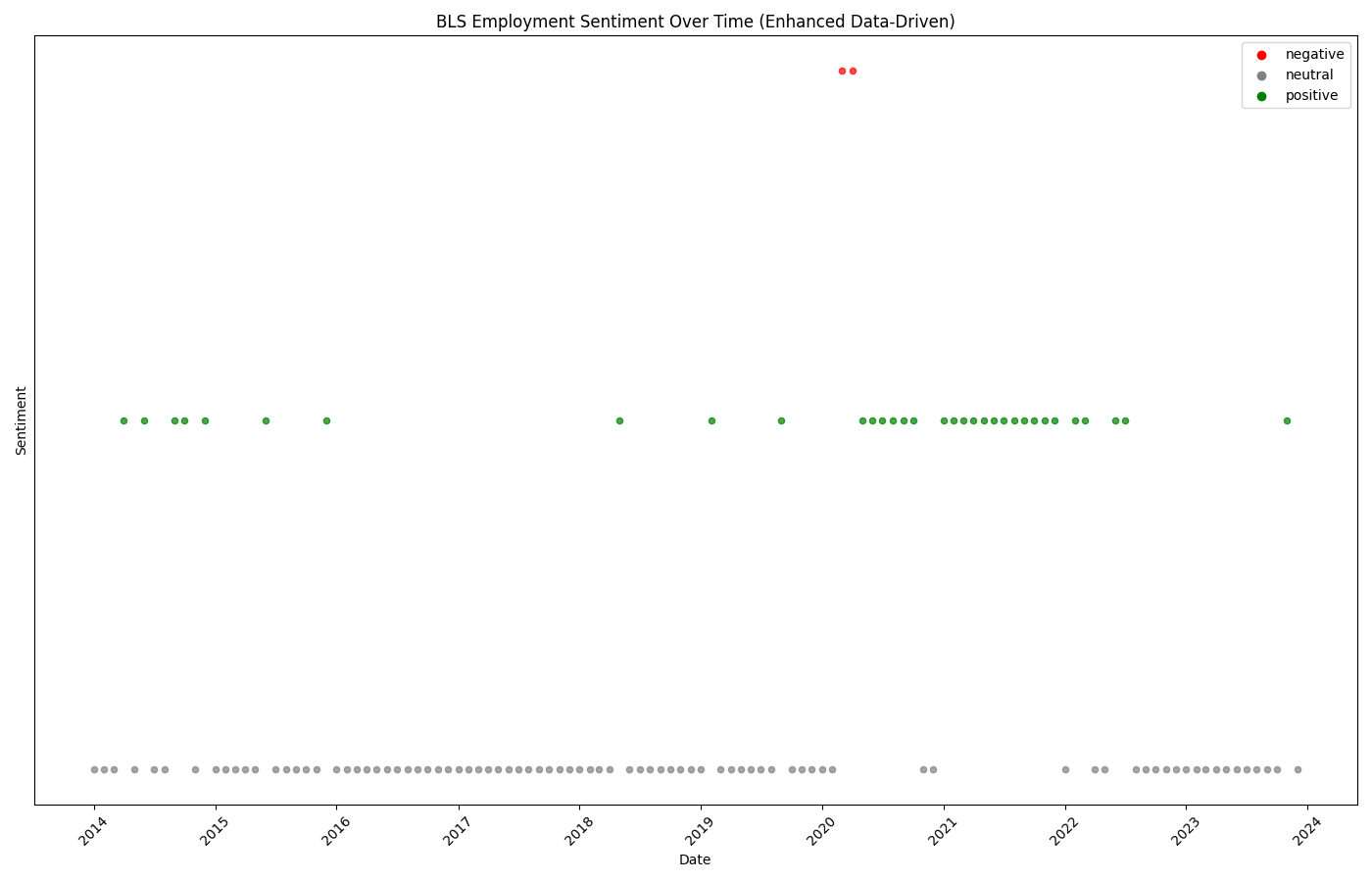

Employment sentiment showing COVID-19 impact in early 2020

Continuous scores revealing sharp pandemic decline to -9.0 and recovery

🔍 Results Interpretation

Pre-Pandemic (2014-2019)

Consistently positive sentiment with minimal volatility, indicating stable labor market expansion

Healthy BaselineCOVID Shock (March 2020)

Dramatic negative spike to -9.0, the most significant labor market disruption in modern history

Crisis DetectionRecovery (2020-2021)

V-shaped recovery pattern as labor markets rebounded with fiscal stimulus and reopening

Rapid ReboundNormalization (2022-2024)

Return to neutral/positive territory, indicating labor market stabilization

Stable Recovery💡 Workforce Intelligence Applications

- Anomaly Detection: Identify unusual labor market patterns (mass layoffs, hiring surges)

- Temporal Trend Analysis: Track long-term workforce composition shifts

- Multi-Source Integration: Combine employment data from multiple government agencies

- Real-Time Monitoring: Monthly updates for proactive workforce planning

🏦 FOMC Monetary Policy Sentiment

🎯 Key Finding

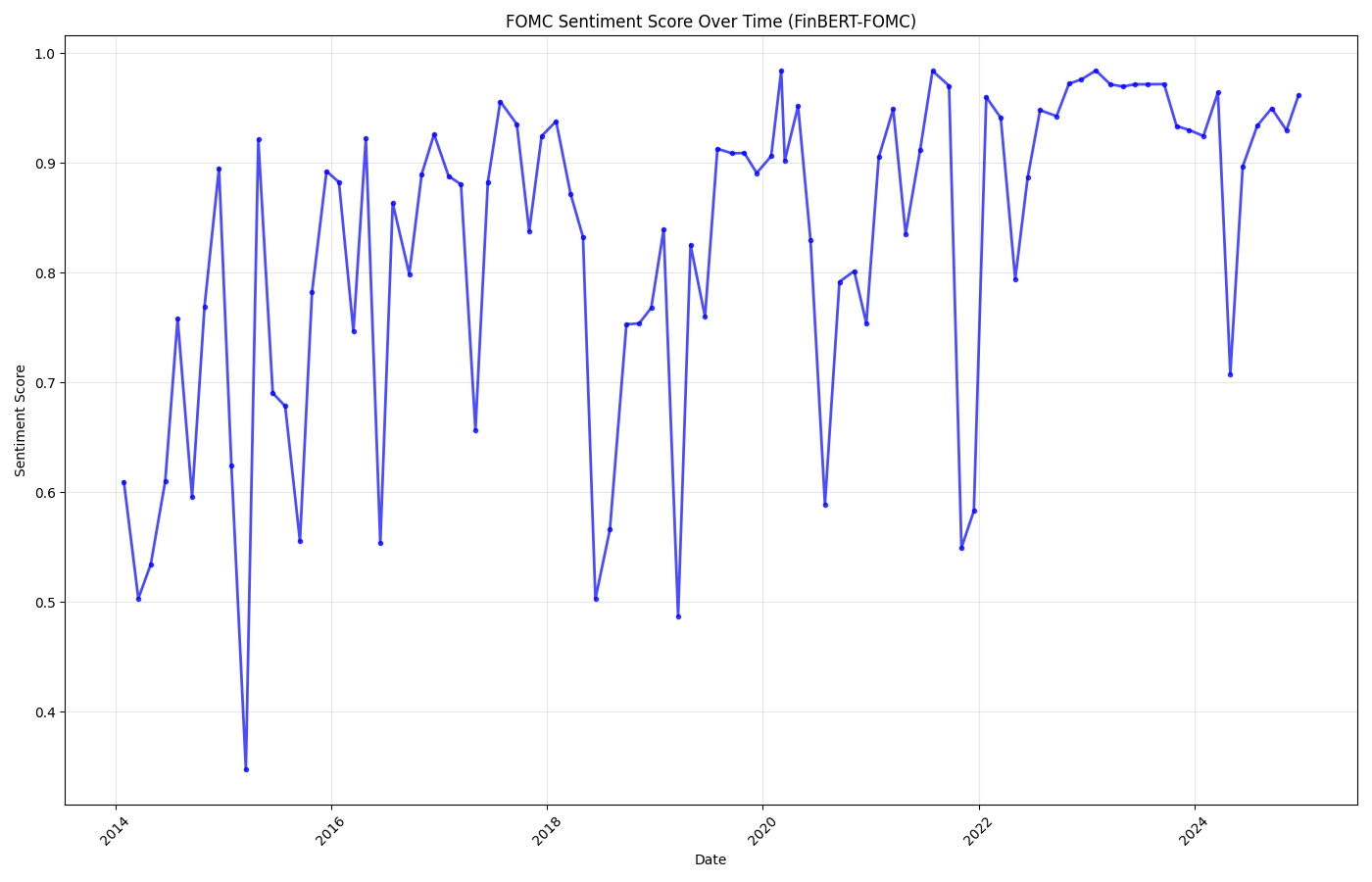

FinBERT-FOMC accurately tracked the Fed's dovish pivot in 2019-2020 and subsequent hawkish turn in 2021-2022 as inflation emerged.

Technical Approach: Transformer-Based NLP

Model: FinBERT-FOMC (pre-trained on Federal Reserve corpus)

Architecture: BERT with financial domain fine-tuning

Confidence Scores: Most predictions 0.7+ (high confidence)

🤖 Model Implementation

📊 Visualizations

📊 Policy Evolution Timeline

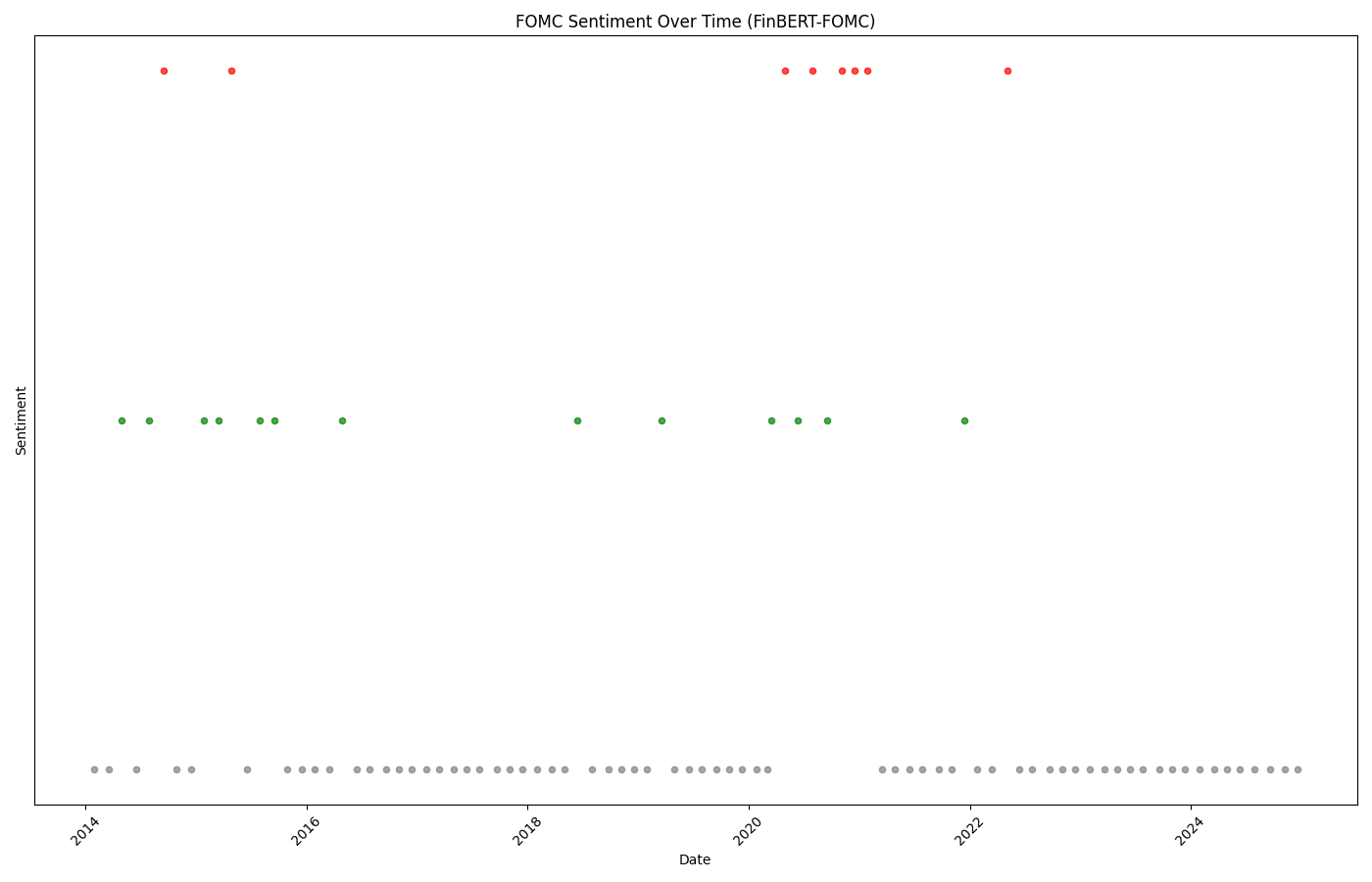

2014-2015: Uncertainty

Negative sentiment (0.3-0.6) during taper tantrum and rate liftoff debates

2019-2020: Dovish Pivot

Positive sentiment (0.9+) as Fed cuts rates and responds to pandemic

2021-2022: Hawkish Turn

Negative sentiment clusters as inflation concerns emerge

2023-2024: Stabilization

Return to neutral/positive as policy normalizes

🔬 Technical Advantages

- Domain-Specific Training: Model trained specifically on Fed language and FOMC statements

- Contextual Understanding: BERT architecture captures nuanced policy signals

- High Confidence: Most predictions above 70% confidence threshold

- Automated Scraping: Real-time analysis of new FOMC statements

📄 SEC 8-K Corporate Filing Analysis

🎯 Key Finding

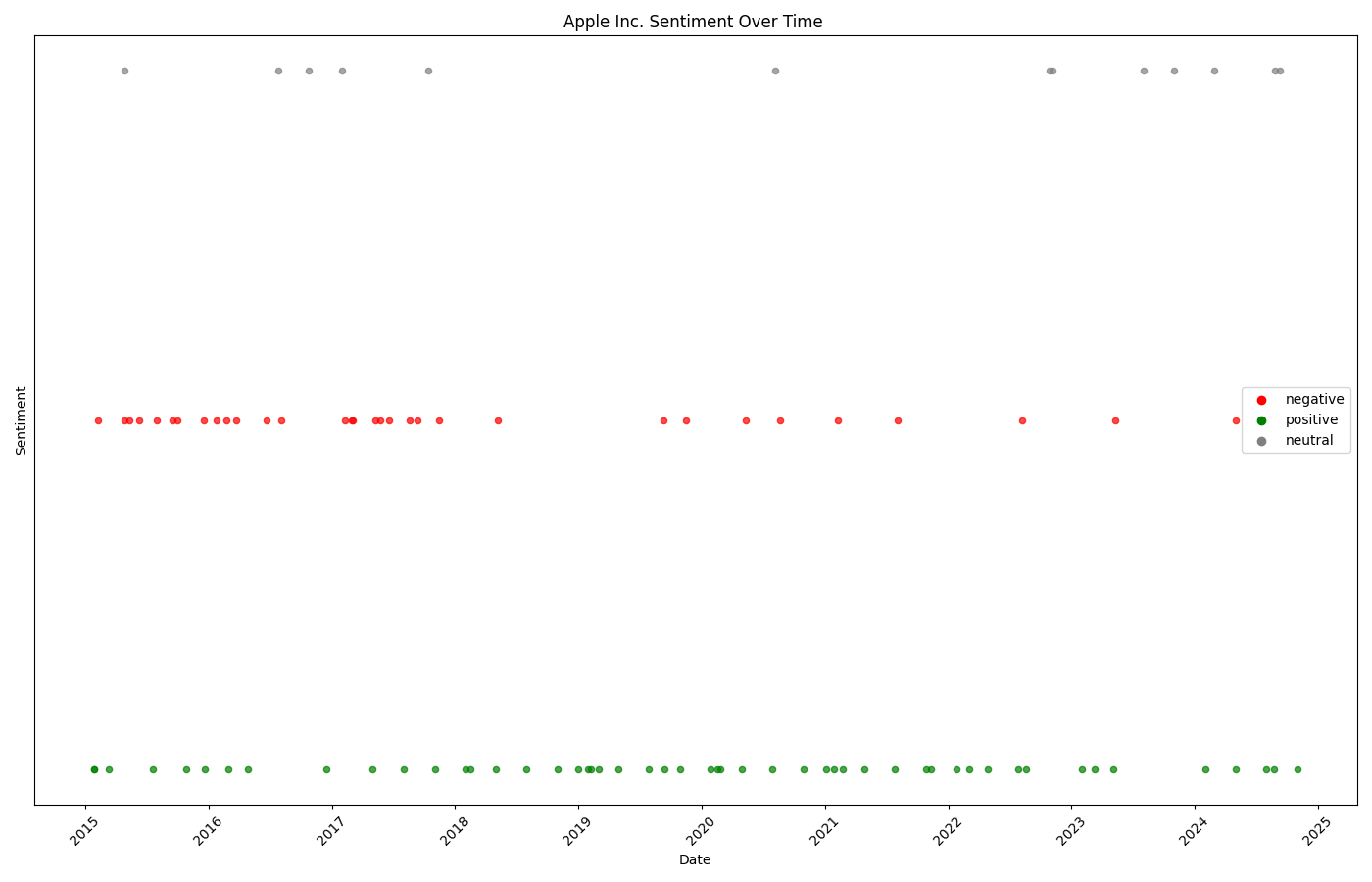

Apple's 8-K sentiment shows 53% positive, 33% negative, 14% neutral filings over 2015-2024, reflecting generally strong corporate trajectory with notable volatility during iPhone transition periods.

Technical Approach: Custom Embedding-Based Analysis

Method: TF-IDF vectorization + custom sentiment axis

Vocabulary: 100+ corporate event terms (positive/negative)

Data Source: SEC EDGAR API with CIK resolution

🎨 Custom Sentiment Axis Construction

📊 Visualizations

📈 Apple's Corporate Event Timeline

2015-2016: Volatility

Mixed sentiment during iPhone 6S/7 era with varied product reception

2017-2018: Positive Cluster

Strong positive sentiment during iPhone X launch and services growth

2020-2021: COVID Impact

Scattered negative events alongside resilient product launches

2022-2024: Maturation

Return to balanced sentiment with mature product cycles

💼 HR Analytics Applications

- M&A Sentiment Analysis: Track workforce integration during acquisitions

- Restructuring Detection: Identify layoff announcements and organizational changes

- Compensation Events: Monitor dividend/buyback announcements affecting employee stock

- Corporate Health: Early warning system for financial distress impacting employment

🏛️ Treasury Fiscal Policy Analysis

🎯 Key Finding

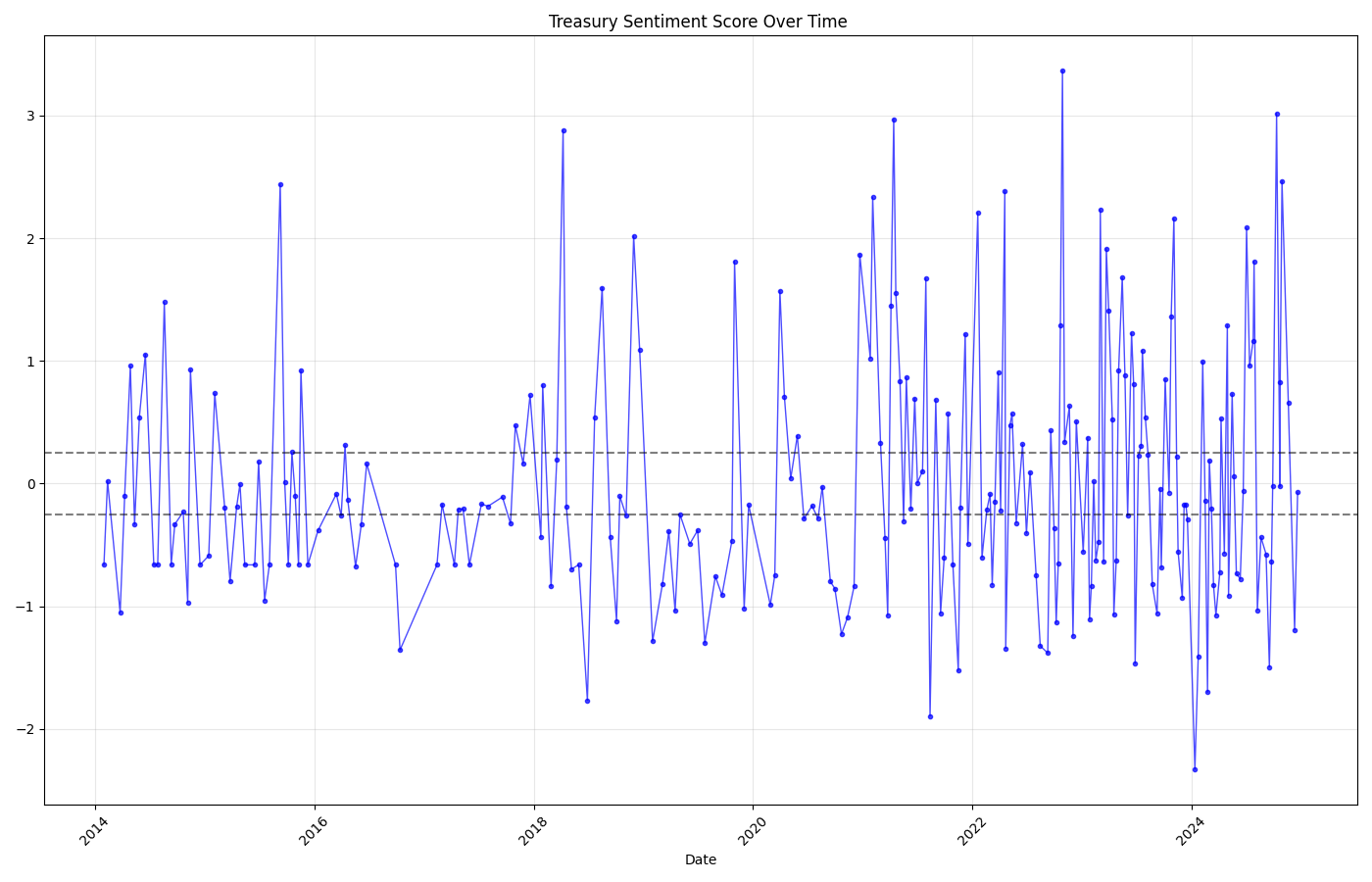

Treasury policy shows overwhelming expansionary stance across three Secretaries (Lew, Mnuchin, Yellen), with the highest spike (score ~3.0) during 2020 COVID relief measures.

Technical Approach: Semantic Vector Analysis

Method: TF-IDF embeddings projected onto fiscal policy axis

Lexicon: 60+ expansionary/contractionary terms

Coverage: 237 press releases across 2014-2025

⚖️ Fiscal Policy Axis Design

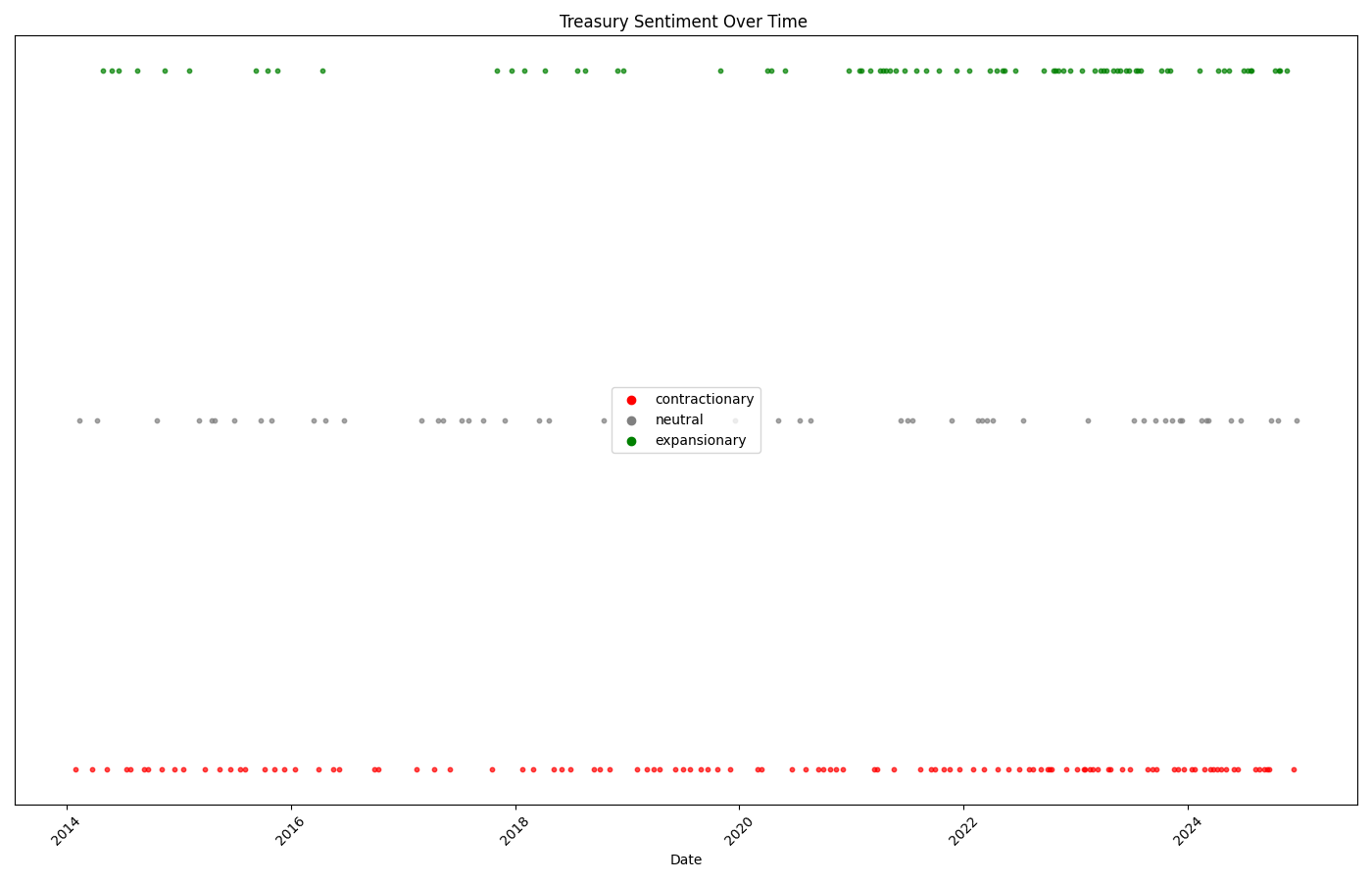

📊 Visualizations

🌊 Policy Evolution Patterns

2014-2019: Recovery Era

Predominantly expansionary during post-recession recovery (Lew/Mnuchin)

Consistent Growth2020: COVID Response

Massive expansionary spike (score ~3.0) during CARES Act implementation

Historic Intervention2021-2022: Infrastructure

Sustained expansion under Yellen with American Rescue Plan

Policy Continuity2023-2024: Moderation

More balanced stance as focus shifts to fiscal sustainability

Stabilization🔍 Workforce Policy Implications

- Job Creation Programs: Expansionary periods correlate with workforce development initiatives

- Infrastructure Hiring: Construction/public works employment tied to fiscal spending

- Public Sector Employment: Government hiring patterns follow fiscal stance

- Skills Training: Investment in workforce development during expansion phases