About Me

Computational scientist with expertise in machine learning, statistical modeling, and scalable system deployment. Developing predictive frameworks and optimization algorithms on cloud infrastructure. PhD from UT Austin with publications in computational physics and data-driven modeling.

Technical Skills

ML/Data Science

- XGBoost, CatBoost, scikit-learn

- PyTorch, SHAP, MLflow

- Hidden Markov Models

Core Libraries

- Python (pandas, numpy, scipy)

- Statistical modeling

- Time series analysis

Optimization

- CVXPY, quadratic programming

- Monte Carlo simulation

- Sparse regression

Cloud & DevOps

- AWS Lambda, Docker

- GitHub Actions, CloudFormation

- Serverless architecture

Experience

Feb 2024 – Present

Quantitative Researcher

Asset Management Firm, Stamford, CT

⚡ Achieved 1.5+ Sharpe ratio with 10% maximum drawdown and 50%+ CAGR on backtested options strategies

Machine Learning & Modeling

- Built ensemble classification system with consensus voting for equity options strategies across multiple expiration cycles

- Deployed CatBoost models with SHAP interpretability for sector rotation achieving 40% annualized alpha

- Designed Hidden Markov Model for regime detection reducing spurious trades by 80%

Optimization & Infrastructure

- Developed dollar-neutral optimizer using CVXPY with beta neutrality constraints

- Architected modular backtesting framework achieving 100–1000x speedup through pandas optimization

- Deployed containerized ML pipeline on AWS Lambda with automated daily execution

- Built serverless infrastructure for real-time option chain monitoring and volatility surface calibration

Aug 2023 – Nov 2023

Computational Engineer

VISIE Inc., Austin, TX

- Implemented TCP/UDP communication modules for robotic-arm control integrated with surgical navigation

- Packaged production system using Poetry and deployed via Azure Artifacts for Series A fundraising

Aug 2022 – Mar 2023

Computational Lead

Sophelio, Austin, TX

- Applied sparse regression on differential operators to discover interpretable governing equations from multi-asset time series

- Built forecasting pipeline using data-driven partial differential equations

Education

PhD

University of Texas at Austin

Doctor of Philosophy in Engineering Mechanics

MS

Indian Institute of Science

Master of Engineering in Mechanical Engineering, Bangalore, India

BS

University of Mumbai

Bachelor of Engineering in Mechanical Engineering, Mumbai, India

Selected Publications

- Dana, S., Ganis, B., and Wheeler, M.F. (2018). A multiscale fixed stress split iterative scheme for coupled flow and poromechanics in deep subsurface reservoirs. Journal of Computational Physics, 352, 1-22.

- Dana, S., Srinivasan, S., et al. (2020). Towards real-time forecasting of natural gas production by harnessing graph theory for stochastic discrete fracture networks. Journal of Petroleum Science and Engineering, 195, 107791.

- Dana, S., Zhao, X., and Jha, B. (2022). A two-grid simulation framework for fast monitoring of fault stability and ground deformation in multiphase geomechanics. Journal of Computational Physics, 466, 111405.

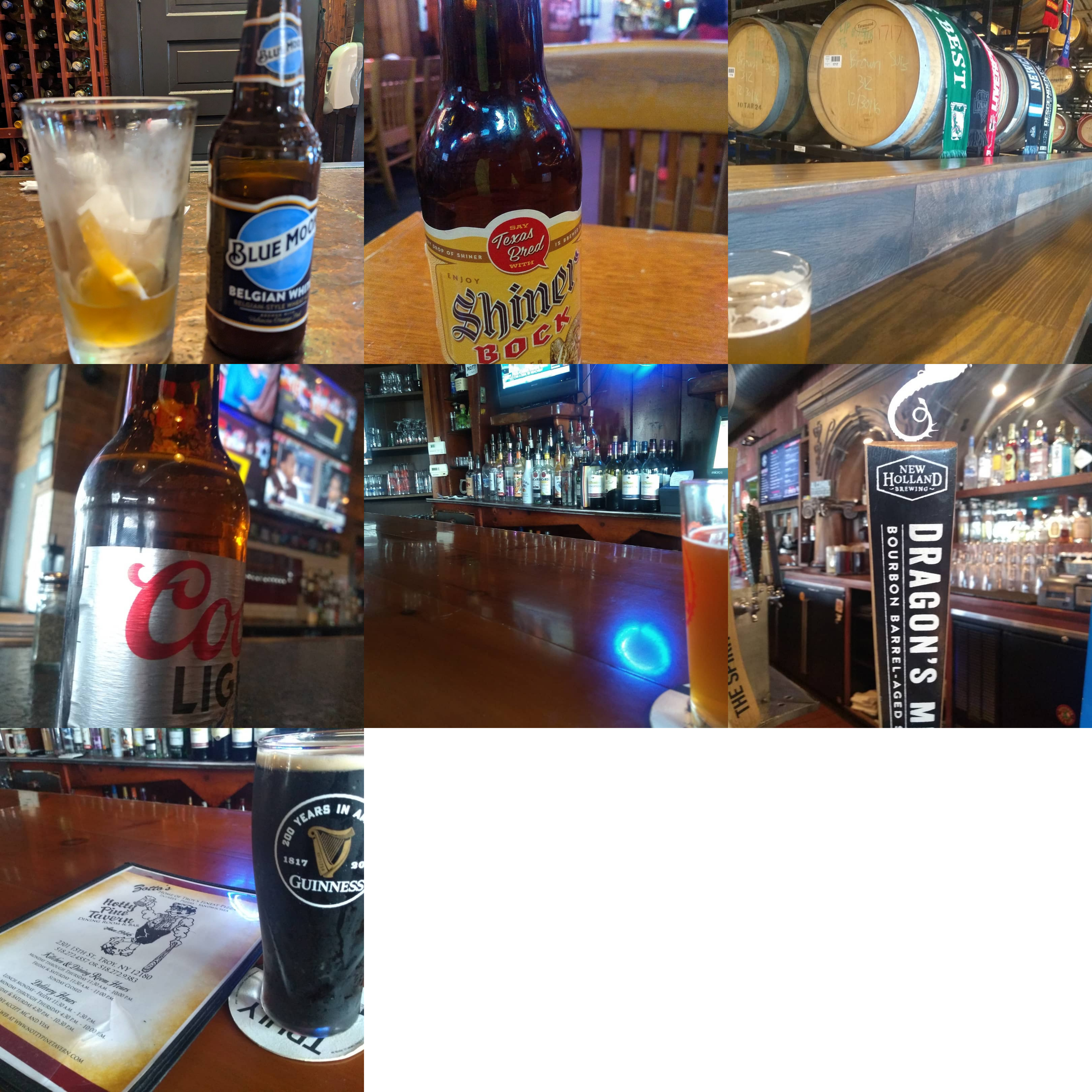

Beyond the Numbers